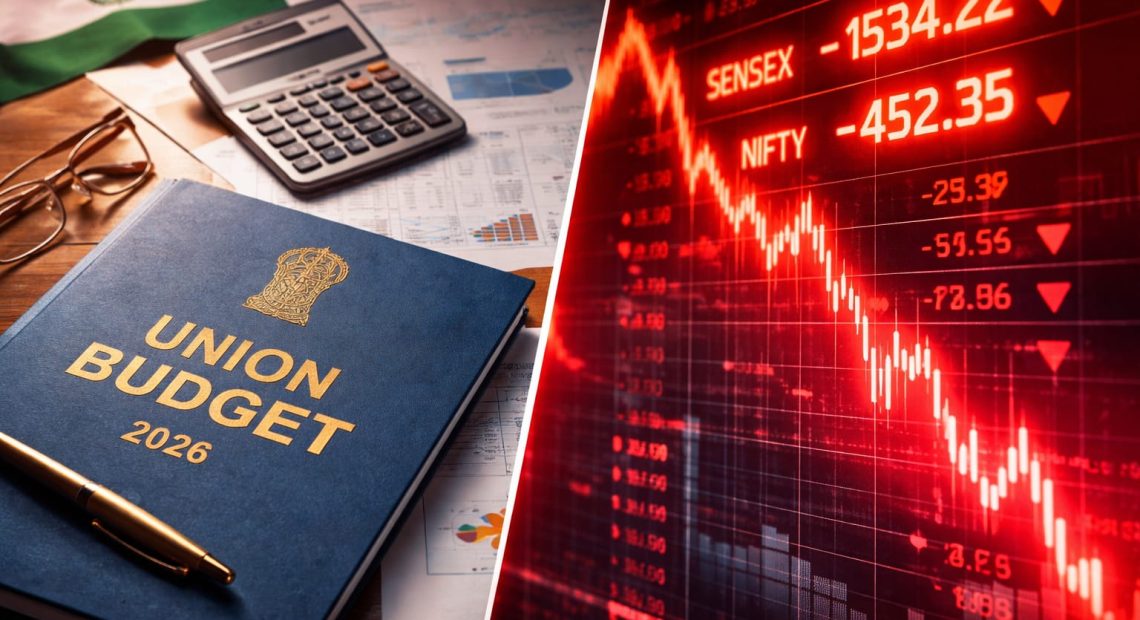

Why Dalal Street Rejected Budget 2026: A Vote of No Confidence From the Markets

Yesterday was not just another volatile Budget day. What unfolded on Dalal Street felt personal. For traders like us, the sharp fall in the Sensex and Nifty was not about charts breaking or stop losses getting hit. It was about expectations being ignored, warnings going unheard, and a growing sense that the people who actually keep India’s markets liquid were an afterthought in this Budget.

Markets do not fall 1,500 points because of mood swings. They fall because confidence cracks. This Budget managed to do exactly that.

The immediate trigger was obvious. The increase in Securities Transaction Tax on derivatives hit the nerve centre of today’s Indian markets. Futures and options are not a fringe activity anymore. They are the backbone of liquidity, price discovery, and volumes. When you raise transaction costs here, you are not taxing speculation, you are taxing participation. Brokerages, exchanges, and market-linked stocks collapsed first for a reason. Traders instantly understood what this meant. Lower volumes, tighter margins, thinner liquidity, and higher friction. In a market already dealing with global uncertainty, this was the last thing anyone needed.

What hurt even more was what did not come. There was no relief on capital gains. No signal that long-term investors or active traders mattered. No effort to make markets more attractive or competitive globally. For months, we were told to expect continuity, stability, and sensitivity to market realities. Instead, we got silence where reassurance was expected.

Look at the sector-wise damage and the message becomes clearer. Financials, brokerages, capital market stocks, and high-valuation names bore the brunt. This was not a random sell-off. It was targeted. Defensive pockets offered little shelter because this was not fear of a global shock. This was disappointment with domestic policy signals. When the very sectors that represent market confidence lead the fall, it tells you sentiment has taken a hit.

As traders, we were not expecting freebies. We were not asking for reckless giveaways. What we expected was acknowledgment. Some relief for the middle class that fuels consumption. Some clarity on deepening capital markets. Some signal that India wants to remain an attractive destination for risk capital. Instead, the Budget felt cautious to the point of being defensive. At a time when confidence needed a push, we got incrementalism and tax tweaks that spooked sentiment.

Context matters here. Valuations were already stretched. Earnings growth has been uneven. Foreign investors have been cautious. Global markets are jittery. This Budget landed at a fragile moment. Instead of stabilising nerves, it added to the unease. Fiscal discipline is important, no trader denies that. But discipline without growth signals feels like driving with the handbrake on.

Higher borrowing numbers, limited cues for private investment, and a clear revenue-first mindset made traders nervous. Markets can live with bad news. What they struggle with is uncertainty and mixed signals. Yesterday felt like the government underestimated how sensitive sentiment already was.

Dismissing this fall as routine Budget volatility would be a mistake. Budget-day reactions matter because they shape perception. They affect IPO appetite, risk-taking behaviour, and the cost of capital. They influence how foreign investors read India’s policy direction. When markets react this sharply, it is not noise. It is a message.

Dalal Street is not rejecting India’s growth story. We trade it every day. What we rejected was the messaging of this Budget. The sense that market participation is easy to tax and hard to value. The feeling that confidence is assumed rather than nurtured.

This sell-off was a vote of no confidence, not in the economy, but in the signals sent yesterday. Traders are asking for clarity, predictability, and respect for how modern markets function. Ignore that message, and the cost will show up not just on screens, but in sentiment, liquidity, and long-term participation.