Union Finance Minister Nirmala Sitharaman recently chaired a comprehensive review meeting of India’s public sector banks (PSBs), directing them to intensify their focus on financial inclusion, digital innovation, and stronger credit practices. The session evaluated each bank’s performance and

The National Payments Corporation of India (NPCI) has recorded a sharp 42% increase in its net profit for the financial year 2024–25, clocking ₹1,552 crore. Alongside this, its total revenue surged to ₹3,270 crore, marking a 42% year-on-year rise. The numbers underline NPCI’s central role in India’s digital payments revolution and its growing stature globally. […]

The Goods and Services Tax (GST) Council is likely to consider a proposal to fully exempt term life insurance and health insurance for senior citizens from GST in its upcoming meeting. The council is expected to take this up before the start of the monsoon session of Parliament, as part of a larger move to […]

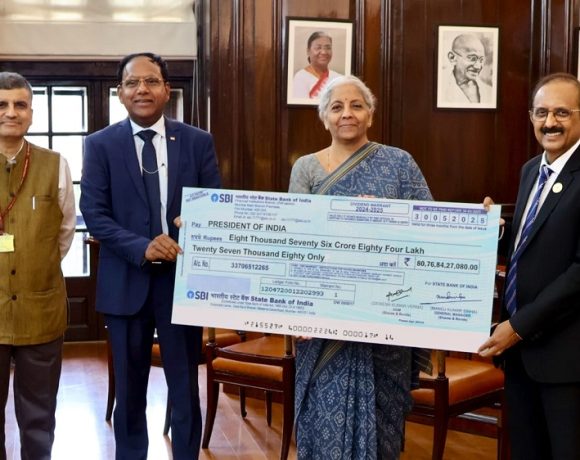

The Government of India has received a dividend of ₹8,076.84 crore from the State Bank of India (SBI) for the financial year 2024–25. This payment marks a significant increase from the ₹6,959 crore received in FY24, reflecting SBI’s sustained financial performance and continued role as a vital revenue contributor for the central exchequer. The cheque […]

The Goods and Services Tax (GST) Council is actively considering eliminating the 12% tax slab from India’s four-tier GST rate structure. The current system includes 5%, 12%, 18%, and 28% slabs. If implemented, the proposal would move all goods and services currently taxed at 12% into either the 5% or 18% brackets. This rationalisation is […]

India’s Unified Payments Interface (UPI) is on the brink of overtaking global financial giant Visa in terms of daily transaction volumes, marking a transformative moment in the global digital payments landscape. On June 1 and 2, UPI processed 644 million and 650 million transactions respectively, pushing it within striking distance of Visa’s global daily average […]

India’s digital payment ecosystem reached a new peak in May 2025, as Unified Payments Interface (UPI) transactions touched a record value of ₹25.14 lakh crore. This marks a significant milestone in the country’s shift toward a cashless economy, with more individuals and businesses embracing digital transactions at unprecedented levels. UPI Transactions May The month

The Reserve Bank of India is widely expected to implement a sharp 50 basis point cut in the benchmark repo rate during its upcoming monetary policy review on June 6. The projection, made by the Economic Research Department of the State Bank of India, marks a significant shift toward monetary easing aimed at reviving a […]

India’s Goods and Services Tax (GST) revenue hit a historic peak in April 2025, with collections soaring to ₹2.37 lakh crore. This marks a 12.6% year-on-year growth from April 2024 and represents the highest monthly GST collection since the system was launched in 2017. The surge was led by strong domestic consumption and robust imports, […]

In a major step towards promoting early financial literacy, the Reserve Bank of India (RBI) has allowed minors aged 10 years and above to independently open and operate their own savings and term deposit accounts. This progressive move aims to instill financial discipline and awareness among children at a younger age. Independent Access for Minors […]