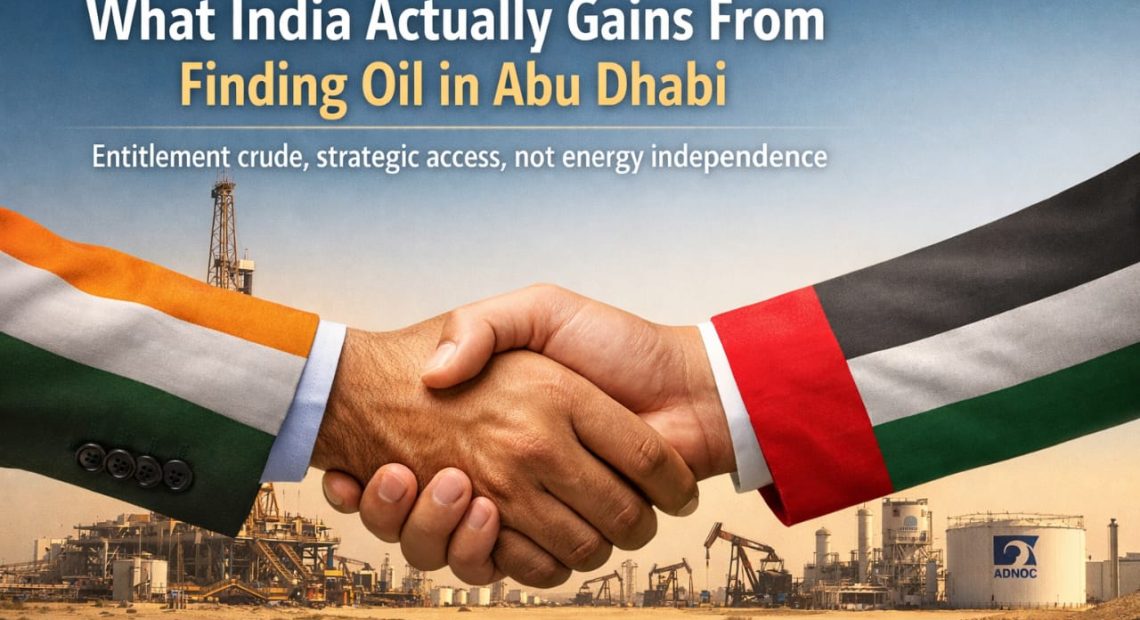

What India Actually Gains From Finding Oil in Abu Dhabi

The news that Indian public sector companies have discovered oil in Abu Dhabi has been widely projected as a major breakthrough. Headlines have done what they usually do, suggesting a leap towards energy security and implying that India has struck oil abroad in a way that meaningfully alters its dependence on imports. The reality is more sober, more technical, and far more instructive. The Abu Dhabi discovery is important, but not for the reasons it is being casually celebrated.

First, it is necessary to be clear about what “finding oil” actually means in Abu Dhabi. The oil belongs to Abu Dhabi. Under UAE law, all hydrocarbons are sovereign property owned by the emirate and administered through Abu Dhabi National Oil Company. Indian companies do not own the oil underground. What they hold is a concession that allows them to explore, develop, and produce oil in a specific block, in return for which they receive entitlement barrels once production begins. This distinction matters because it separates political symbolism from economic reality.

India gained access to exploration rights through a competitive process, not diplomatic favour. In 2019, ADNOC opened onshore and offshore blocks to global bidding as part of a strategy to diversify partners and attract capital and expertise. Indian Oil Corporation and BPCL’s upstream arm, Bharat PetroResources, jointly bid for and won Abu Dhabi Onshore Block 1 through their joint venture Urja Bharat. This gave the Indian consortium full responsibility for exploration and appraisal, along with the financial risk that comes with it. The recent discovery is the result of that drilling effort, not a transfer of an existing producing asset.

So what does India gain in practical terms. The first gain is entitlement crude. If the discovery is declared commercially viable and production is approved, the Indian consortium will receive a share of the produced crude proportional to its participating interest after ADNOC exercises its option to enter the development phase. That crude can be shipped to India for refining by IOC or BPCL, sold in international markets, or swapped commercially. It is supply flexibility, not ownership.

The second gain is upstream capability and credibility. Operating an onshore block in one of the world’s most tightly regulated and technically demanding oil provinces is not trivial. Success here signals that Indian public sector companies can compete with global players on geology, drilling, and reservoir evaluation. That credibility improves India’s standing in future bid rounds, not just in the UAE but globally.

The third gain is strategic insulation. Even small volumes of entitlement crude provide a hedge against supply disruptions and price spikes. Overseas upstream assets are not meant to replace imports. They are meant to smooth volatility and reduce exposure to spot market shocks.

What this discovery does not do is change India’s energy arithmetic. India consumes close to six million barrels of oil per day and imports roughly 85 percent of that requirement. Even in an optimistic scenario, the Abu Dhabi block is unlikely to yield Indian entitlement beyond a few tens of thousands of barrels per day. That is well under one percent of daily demand. This discovery does not make India energy secure, does not reduce import dependence in a meaningful way, and does not compensate for declining domestic production.

The real significance of the Abu Dhabi discovery lies in what it represents, not what it supplies. It shows that Indian companies can win competitive overseas concessions, execute exploration successfully, and earn a seat at the upstream table in resource-rich regions. It is a strategic brick, not a structural pillar. Treating it as anything more risks confusing competence with sufficiency.

India found oil in Abu Dhabi. What it actually gained was access, credibility, and optional supply, not a shortcut to energy independence.