US Tariff Revenue Surges Past $100 Billion This Year

The United States Treasury has reported a significant jump in customs revenue, with tariff collections crossing $100 billion in the first nine months of the 2025 fiscal year. This surge comes amid continued enforcement of high import duties under President Donald Trump’s trade policy agenda.

June Sees Rare Budget Surplus

The federal government posted a $27 billion budget surplus in June, a sharp turnaround attributed largely to customs duty collections. Gross tariff revenue for June stood at $27.2 billion, with net collections at $26.6 billion—nearly four times higher than the amount collected in June last year. This boost played a key role in pushing total net customs duties past $108 billion so far this fiscal year.

Treasury Projects $300 Billion by Year-End

According to the US Treasury Department, the country is on track to hit $300 billion in customs duties by the end of the fiscal year if current trends continue. Treasury Secretary Scott Bessent remarked that the government is “reaping the rewards” of the current tariff structure, calling it a successful tool for both revenue generation and trade rebalancing.

Rising Prices Hit Consumers and Industry

While tariff income has benefited government finances, American manufacturers and consumers are grappling with the side effects. The average tariff rate now exceeds 16%, the highest in nearly a century. Input costs for industries dependent on imported steel, aluminum, and electronics have increased substantially, and retail prices on a range of consumer goods are rising. Between January and May, global steel prices alone rose by 30%, impacting multiple sectors including construction and automotive manufacturing.

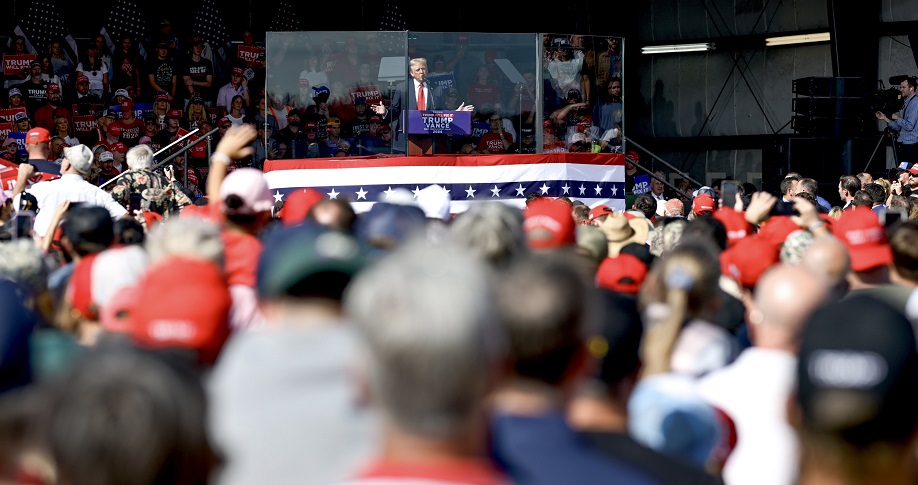

Trump’s Tariff Strategy

These results stem from the Trump administration’s aggressive tariff policies aimed at protecting domestic industries. Duties ranging between 10% and 50% have been imposed on imports from China, Canada, the European Union, and others. While supporters argue this strengthens American industry and deters unfair trade practices, critics warn of inflationary risks and reduced global competitiveness.