US Imposes 50% Tariff on Brazil Over Political Dispute

The United States has announced a sharp 50% tariff on most imports from Brazil, set to take effect on August 6, following a U.S. executive order signed by President Donald Trump on July 30, 2025. This action is described as a response to political developments in Brazil and is meant to protect U.S. economic interests.

Measures Linked to Brazil’s Political Climate

The U.S. government justified the move by calling Brazil’s political handling of former President Jair Bolsonaro’s prosecution an “economic emergency.” It also accused Brazilian courts, especially Supreme Court Justice Alexandre de Moraes, of suppressing free speech by ordering social media platforms to censor speech and targeting critics of Bolsonaro.

Sectors Exempted from High Tariffs

Not all trade is affected equally: the order exempts goods such as civil aircraft, energy products, aluminum, wood pulp, fertilizers, and tin from the full surcharge. These industries were granted relief amid concerns over broader disruptions in supply chains.

Economic Fallout and Reactions

Brazilian oil companies have halted exports to the U.S. pending clarity on exemption status. Agricultural exporters fear serious impact: Brazil provides a major share of U.S. imports in orange juice, coffee, sugar, and beef. Analysts say beef and coffee exporters remain exposed to the full tariff. Some major firms have already estimated hundreds of millions in direct cost increases.

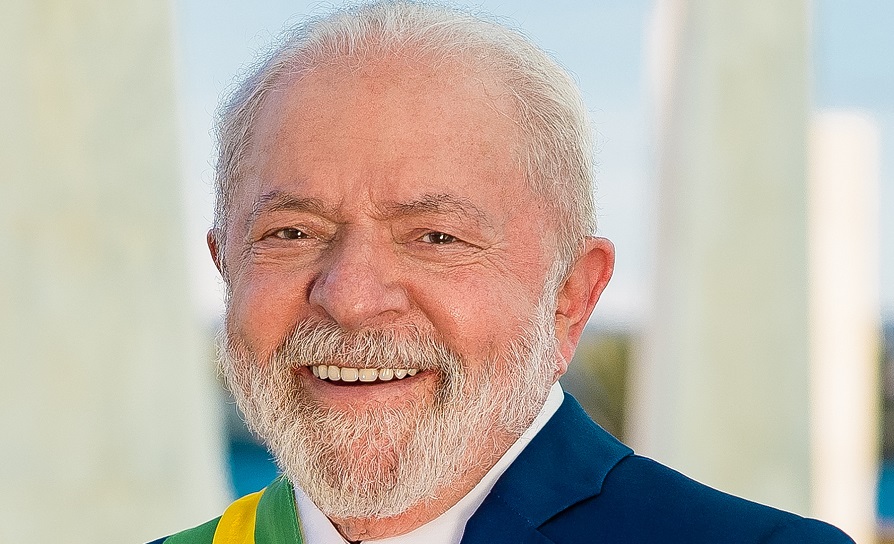

Brazilian President Luiz Inácio Lula da Silva has denounced the tariffs as unjust and vowed to defend national sovereignty. While Brazil stated it is open to dialogue, officials warned the country may respond in kind if measures continue.

Broader Trade Strategy by U.S.

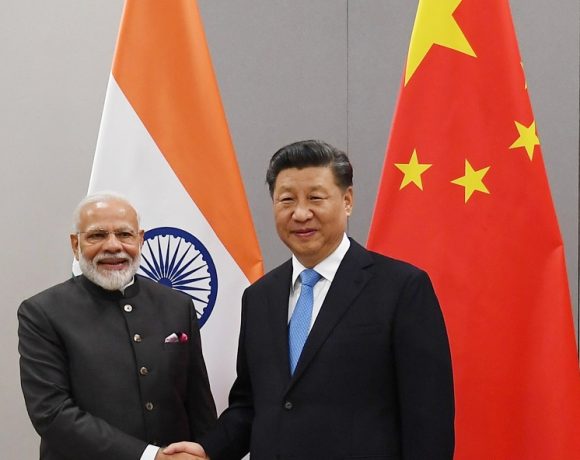

This move complements earlier U.S. actions against other trade partners. Trump previously imposed similar tariffs on India and hinted at expanding such measures elsewhere. The road ahead may see Brazil negotiating tariff terms or retaliating at the World Trade Organization, while global markets brace for ripple effects.