UPI Set to Surpass Visa in Daily Transactions

India’s Unified Payments Interface (UPI) is on the brink of overtaking global financial giant Visa in terms of daily transaction volumes, marking a transformative moment in the global digital payments landscape. On June 1 and 2, UPI processed 644 million and 650 million transactions respectively, pushing it within striking distance of Visa’s global daily average of 639 million transactions.

With an average of 602 million transactions per day in May, UPI has demonstrated a consistent growth trend. This 4.4% increase over April further cements its place as a serious contender to become the world’s most used retail interbank payment system.

Real-Time Advantage and Inclusive Design

One of the key factors driving UPI’s meteoric rise is its real-time settlement capability. Unlike traditional card networks, which rely on delayed clearing processes, UPI transactions are settled instantly. This provides users with immediate confirmation and access to funds, fostering higher trust and adoption among both consumers and merchants.

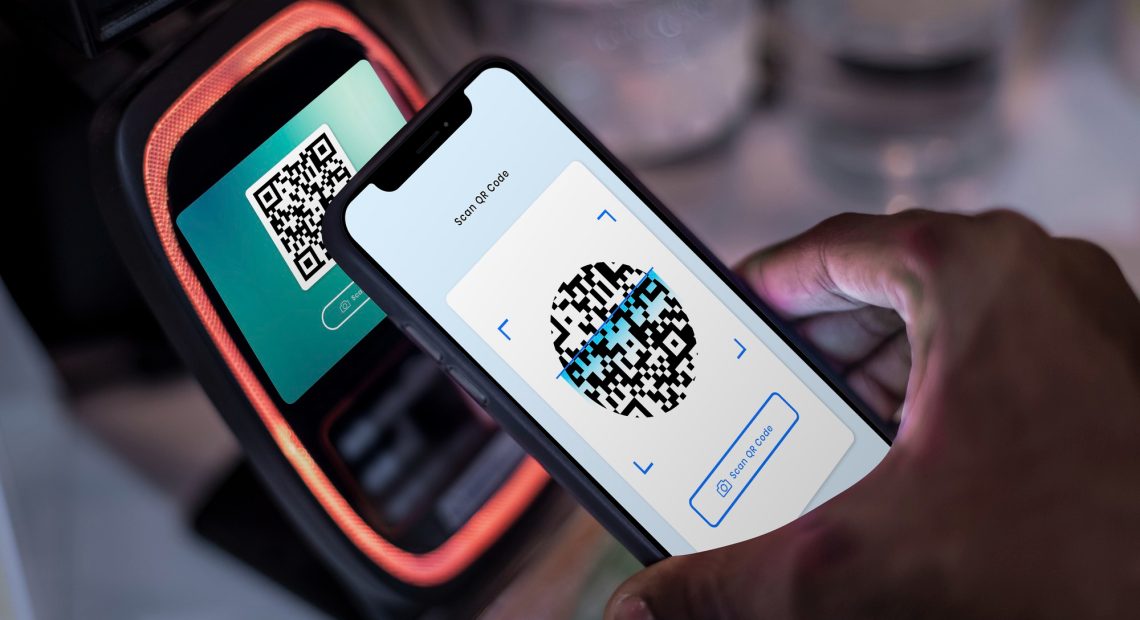

Moreover, UPI’s ease of use, multilingual support, and seamless integration with mobile apps have allowed it to reach millions of users across urban and rural India. Its compatibility with multiple platforms, including QR code-based payments, has accelerated its adoption across small businesses and informal sectors.

Digital India and Global Aspirations

The Indian government’s aggressive push for a cashless economy has played a pivotal role in propelling UPI’s growth. With initiatives supporting digital infrastructure, merchant onboarding, and public awareness, the foundation has been laid for widespread digital financial inclusion.

Looking ahead, UPI’s ambitions extend beyond domestic dominance. The platform is preparing for international expansion, aiming to launch services in 20 countries by the end of the decade. This global outreach is expected to redefine cross-border payments and challenge the long-standing dominance of legacy card networks.

As UPI closes in on surpassing Visa, it is no longer just a national success story — it is emerging as a blueprint for the future of digital finance worldwide.