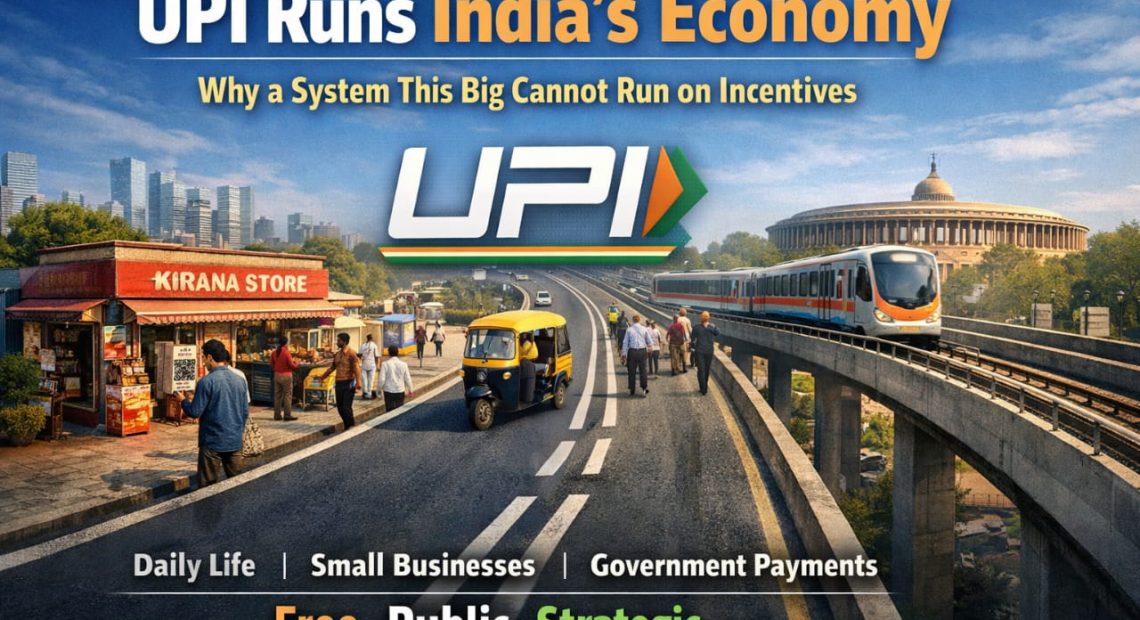

UPI Is National Infrastructure and a Strategic Asset

UPI now moves more money every year than most national infrastructure projects ever will. ₹230 trillion in transactions is not a fintech milestone. It is the backbone of India’s retail economy, quietly powering daily commerce, household payments, small businesses, transport systems, and even government flows. And yet, for something this large, this critical, and this transformative, India still funds UPI like a temporary scheme rather than a permanent national asset.

UPI is no longer a payments product

UPI crossed the line from innovation to infrastructure years ago. When a system becomes so deeply embedded that even a few hours of disruption would stall markets, delay wages, paralyse merchants, and anger millions of citizens, it stops being optional. UPI today is as essential to economic movement as roads are to physical movement. It is used by street vendors and stock traders, autorickshaw drivers and airlines, municipal bodies and ministries. This is not experimentation. This is dependency.

UPI as a strategic asset

Beyond convenience, UPI quietly altered India’s strategic position. It reduced dependence on foreign card networks, kept transaction data within Indian jurisdiction, and ensured that the country’s retail payment rails are not controlled by external commercial interests. In a world where financial choke points are increasingly weaponised, control over domestic money movement is not a technical detail. It is sovereignty. UPI did what decades of banking reforms never fully achieved. It gave India control over its own payment backbone.

The funding contradiction

Despite this, UPI still runs on annual incentive schemes and temporary compensation mechanisms. Banks and payment service providers are reimbursed through policy decisions that are debated every budget cycle. Compare this with physical infrastructure. No one asks whether highways should earn tolls before they are built. No one questions whether railways deserve budgetary support because tickets do not recover full costs. Yet UPI, which moves far more economic value than many physical assets, is still treated like a programme that must justify its existence every year.

Zero MDR is deliberate policy, not a mistake

Zero MDR was not an accident. It was a conscious state decision to maximise adoption, inclusion, and scale. Charging merchants, even marginally, would have slowed adoption in small towns, revived cash usage, and reopened space for foreign card dominance. The benefits of zero MDR far exceed its fiscal cost. Formalisation, tax compliance, reduced cash handling, and economic transparency generate returns that dwarf the subsidy outlay.

Why UPI needs a formal budget line

If UPI is national infrastructure, it needs predictable funding. A dedicated annual allocation would remove policy uncertainty, end endless debates about monetisation, and allow long-term planning. Cybersecurity hardening, system redundancy, disaster recovery, and capacity expansion cannot depend on ad-hoc incentives. Strategic assets require strategic budgeting.

Expansion and resilience require seriousness

UPI’s next phase is not optional. Cross-border payments, offline resilience, feature-phone access, credit-on-UPI, autopay expansion, and international interoperability all demand investment. These are not cosmetic upgrades. They determine whether UPI remains resilient, inclusive, and globally competitive. No serious infrastructure system is built or maintained on temporary funding.

The cost versus the return

Even a few thousand crore rupees annually is trivial when set against ₹230 trillion in transaction value. The return on investment is unmatched. Reduced cash logistics, higher efficiency, improved compliance, and economic inclusion at population scale. There are few public investments that deliver so much value at such low cost.

The risk of complacency

The biggest danger now is success fatigue. UPI works so well that it risks being taken for granted. Strategic assets fail not when they are attacked, but when they are underfunded and ignored. Treating UPI as “already successful” is how fragility creeps in quietly.

India built something rare. A world-class digital public infrastructure that delivers daily value, strengthens sovereignty, and empowers citizens without friction. The next step is obvious. UPI must be formally recognised as national infrastructure and funded accordingly, not reluctantly, not temporarily, but permanently.