U.S. raises Canada tariff to 35%

The United States has officially increased tariffs on certain Canadian goods from 25% to 35%, effective August 1. The decision is part of a broader trade shift under President Donald Trump’s administration targeting countries deemed non-compliant with U.S. trade and security expectations.

Tariff Applies to Non-Compliant Products

The 35% tariff will apply to Canadian exports that do not meet rules set under the U.S.-Mexico-Canada Agreement (USMCA). Goods that comply with USMCA requirements will remain exempt. Affected items include steel, aluminum, lumber, and select auto parts.

U.S. Cites Border Security Concerns

American officials defended the move by linking it to national security and border enforcement. They alleged that Canada had failed to adequately control the movement of synthetic opioids and other drugs across the northern border. The new tariffs are intended as a pressure mechanism to prompt stricter enforcement measures.

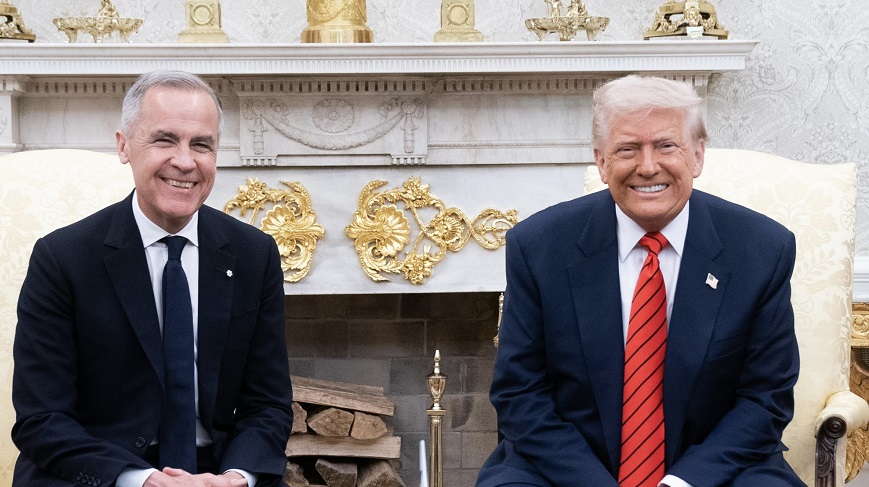

Canada Expresses Disappointment

The Canadian government responded by expressing concern over the escalation. Officials said Canada remains a cooperative partner and that its contribution to the flow of illegal substances into the U.S. is minimal. They vowed to safeguard Canadian industries and seek a diplomatic solution.

Possible Retaliatory Measures Ahead

In response to the tariff hike, Canadian provinces including Ontario have hinted at the possibility of imposing retaliatory duties on U.S. exports, particularly metals. While Canada has not announced specific countermeasures yet, officials confirmed they are reviewing all options.

Larger Trade Agenda in Play

The tariff on Canada comes amid a broader U.S. trade overhaul involving new duties on imports from countries such as India, Brazil, and Taiwan. Tariff rates now range from 10% to 50% depending on each nation’s compliance with U.S. demands. Canada is one of the few developed nations to face the 35% threshold.

Outlook for U.S.–Canada Relations

Trade experts warn that prolonged tariff disputes between two of the world’s closest trading partners could disrupt supply chains and lead to higher costs for consumers in both countries. Ongoing talks are expected in the coming weeks, but the situation remains tense.