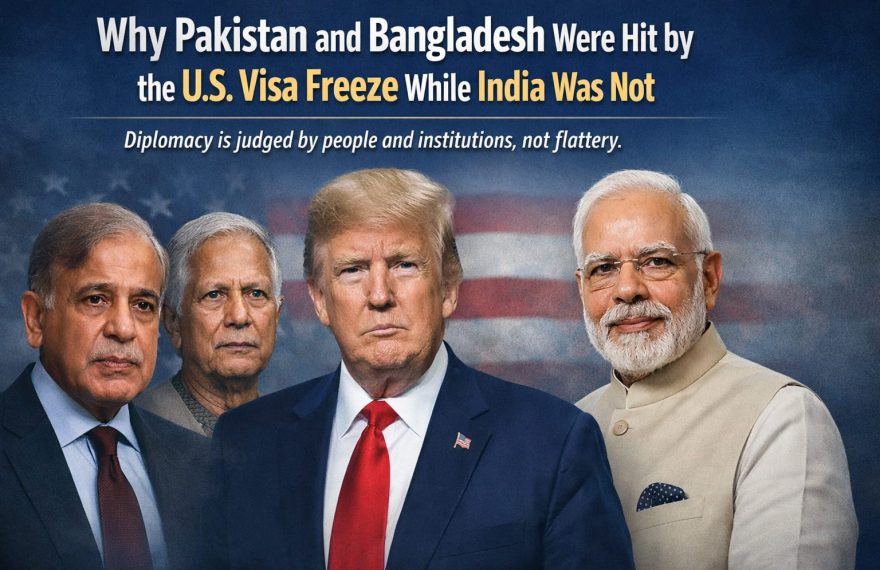

The United States’ decision to freeze immigrant visa processing for citizens of 75 countries has triggered predictable outrage, denial, and conspiracy theories across South Asia. But stripped of emotion and online noise, the policy outcome itself tells a far more uncomfortable truth. Pakistan

Bangladesh has temporarily suspended most visa services at its diplomatic missions in India, citing security-related concerns. The decision affects visa processing at the Bangladesh High Commission in New Delhi and its deputy high commissions in Kolkata and Agartala. Officials said the move is precautionary and will remain in force until the situation is reviewed. Security

India has launched a new e-Business visa category for Chinese nationals to facilitate smoother entry for business-related activities. The visa, officially introduced at the start of January, allows eligible Chinese citizens to apply online for short-term business travel to India without visiting an Indian embassy or consulate. Purpose of the e-Business Visa The new visa

A growing number of Indian immigrants in the United States are restricting travel and staying indoors as anxiety rises over tighter visa scrutiny and immigration enforcement. The heightened caution spans undocumented migrants as well as legally present workers on temporary visas, reflecting widespread concern about delays, additional checks, and the risk of being unable to

France and the European Union have sharply criticised the United States after Washington imposed visa restrictions on several European figures linked to digital regulation and campaigns against online hate and misinformation. The move has triggered fresh diplomatic tension between the two sides, with EU leaders accusing the US of overreach and intimidation. Visa Curbs

A U.S. federal judge has upheld a controversial $100,000 fee on new H-1B visa applications, rejecting a legal challenge from major U.S. business groups. The decision supports President Donald Trump’s immigration policy aimed at reducing reliance on skilled foreign workers and encouraging employers to hire American workers. Court decision on H-1B fee The judge ruled […]

The Bangladesh High Commission in New Delhi has temporarily suspended all consular and visa services until further notice, according to an official notice issued by the mission. The suspension applies to visa processing as well as other routine consular services and has been attributed to unavoidable circumstances. Applicants have been advised to monitor official

The United States government has announced the suspension of the Diversity Immigrant Visa program (commonly known as the green card lottery), pausing the issuance and processing of new visas under the scheme. The decision was directed by President Donald Trump and announced by Homeland Security Secretary Kristi Noem as part of broader changes to U.S. […]

The Government of India has introduced a simplified and streamlined visa process to help domestic companies bring in foreign professionals, including engineers and technical experts, whose skills are needed for key production and industrial projects across the country. The changes are expected to reduce delays and procedural hurdles that previously affected the entry of

A group of 20 US states has filed a lawsuit against the Donald Trump administration over a steep increase in H-1B visa fees, arguing that the move will hurt American businesses and undermine the country’s ability to attract skilled foreign talent. The states have described the fee hike as excessive and unlawful, saying it goes […]