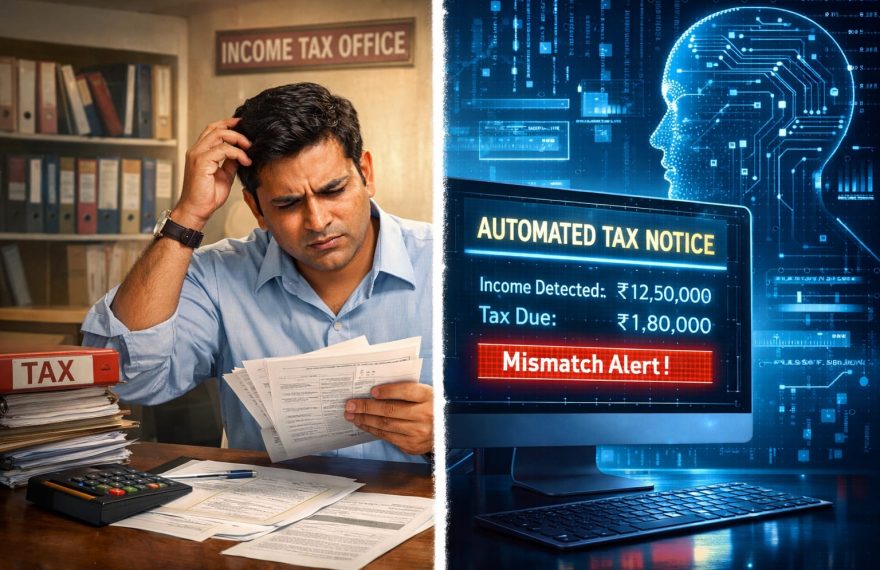

The government’s draft Income Tax Rules 2026 look harmless at first glance. Fewer forms, simpler language, pre-filled returns and faster processing. A routine modernization exercise, one might think. But buried inside this reform is something much bigger. India is quietly moving from a human

The People’s Republic of China has ended a longstanding tax incentive for gold retailing, which had allowed certain gold sellers to offset value-added tax (VAT) on sales. Under the revised rules effective immediately, gold retailers will no longer receive the tax relief and may pass increased costs to consumers. Market Implications China is the world’s […]

Chief Justice of India B. R. Gavai has highlighted that disputes worth ₹6.85 lakh crore remain pending before the Income Tax Appellate Tribunal (ITAT). He shared this while addressing a symposium on the role and challenges faced by the tribunal. Reduction in Case Backlog Justice Gavai praised ITAT’s progress in clearing cases, noting that the […]

Prime Minister Narendra Modi, speaking at the inauguration of the UP International Trade Show in Greater Noida, said that as India’s economy becomes stronger, the tax burden on citizens will reduce further. He attributed this to ongoing reforms in the Goods and Services Tax (GST) system and structural changes in taxation. What Tax Relief Includes […]

The GST Council, chaired by Finance Minister Nirmala Sitharaman, has approved sweeping reforms to India’s Goods and Services Tax (GST), effective from 22 September 2025, coinciding with the Navratri festival. New GST Structure Under the new framework, the existing four tax slabs—5%, 12%, 18%, and 28%—are replaced by a simplified two-slab structure of 5% and […]

The 56th GST Council meeting will be held on September 3 and 4, 2025, in New Delhi. Both sessions will begin at 11 a.m., while a preparatory officers’ meeting is scheduled for September 2. Proposal for Two Main Slabs The Centre is expected to present a proposal to reduce the goods and services tax (GST) […]

The Group of Ministers (GoM) on GST rate rationalisation has approved the Centre’s proposal to simplify the goods and services tax system. The panel has recommended scrapping the 12% and 28% slabs and consolidating the structure into just two major rates — 5% for essential and merit goods and 18% for standard items. Shift of […]

The Indian government has formally withdrawn the Income Tax Bill, 2025, which was introduced in the Lok Sabha on February 13. The decision follows a detailed review and feedback from a parliamentary select committee that identified several provisions needing revision. Why Was the Bill Pulled Back? Key areas flagged for changes include provisions related to […]

A parliamentary panel reviewing the draft Income Tax Bill, 2025 has recommended that small taxpayers should be allowed to claim income tax refunds even if they fail to file their returns by the deadline. The suggestion comes as a relief for individuals earning below the taxable limit who often lose their deducted tax (TDS) due […]

India’s digital economy was supposed to be a story of empowerment — of chaiwalas flashing QR codes, fruit vendors skipping change hassles, and small businesses riding the wave of UPI-powered inclusion. But just when the country seemed to be turning the corner on cash, the bureaucracy decided to remind everyone who’s really in charge. The […]