The Reserve Bank of India (RBI) has begun discussions with stakeholders to review and potentially relax rules governing overseas investments by Indian entities, aiming to improve capital access and support global expansion of domestic companies. RBI Overseas Investment Norms Review Officials

The Reserve Bank of India (RBI) kept the benchmark repo rate unchanged in its first monetary policy decision after the Union Budget, maintaining its cautious approach amid moderating inflation and steady economic growth signals. RBI Repo Rate Decision After Budget The Monetary Policy Committee decided to hold the repo rate steady, signalling continuity in its […]

The Reserve Bank of India on Wednesday began its Monetary Policy Committee meeting to assess macroeconomic conditions and decide on the future course of interest rates. Rate Decision Due on Friday The three-day meeting will conclude on Friday, when the RBI will announce its policy decision. The committee will review inflation trends, growth indicators, liquidity […]

The Indian rupee has logged its worst monthly performance in three years, weakening sharply against the US dollar during January. Persistent pressure from foreign fund outflows and strong dollar demand pushed the currency close to record lows. RBI Steps In to Defend Key Level The rupee slipped near the ₹92 per dollar mark during the […]

India recently crossed a major financial milestone. Its foreign exchange reserves went past $700 billion. This should have been big news, but it barely caused a ripple. There were no speeches, no celebrations, and no political chest-thumping. That silence itself tells an important story. India’s most important economic achievement today is not fast growth or […]

India’s central bank has quietly made one of the most economically consequential proposals in recent BRICS discussions. By urging the government to place interoperability of central bank digital currencies on the BRICS agenda, the Reserve Bank of India is not chasing ideological headlines or currency symbolism. It is targeting a very old and very expensive […]

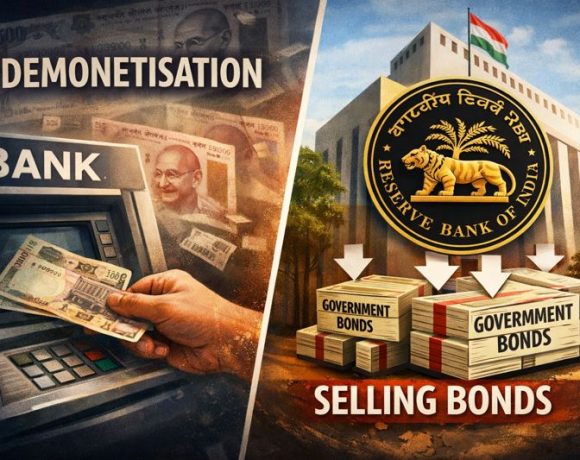

Introduction In simple terms, this article explains what really happened to money in the system after demonetisation and why the Reserve Bank of India later had to remove money instead of adding it. A common belief is that demonetisation created such a severe cash shortage that RBI was forced to print money to keep banks […]

India’s foreign exchange reserves rarely make headlines unless something breaks. They are meant to sit quietly in the background, doing their job of protecting the economy from shocks. That is why the Reserve Bank of India trimming its US Treasury holdings below 200 billion dollars while steadily increasing gold reserves is worth paying attention to. […]

The Reserve Bank of India (RBI) has said that low inflation in India is helping to support the country’s global competitiveness and sustain economic momentum. In its latest assessment of economic indicators, the central bank noted that even though headline consumer price inflation edged up slightly in November, it stayed below the lower tolerance limit […]

The governor of India’s central bank has indicated that the country’s key interest rates are likely to remain low for an extended period as the economy continues to grow steadily. The comments came in the context of ongoing monetary policy discussions and reflect the central bank’s assessment of inflation and economic conditions. Governor’s Outlook on […]