The US Federal Reserve has decided to keep its benchmark interest rates unchanged, maintaining its current policy stance despite continued calls from President Donald Trump for rate cuts. The decision was taken at the central bank’s latest policy meeting as officials assessed economic

The Government of India has decided to maintain steady interest rates on key small-savings schemes—including Public Provident Fund (PPF), National Savings Certificate (NSC), Sukanya Samriddhi Yojana (SSY), Senior Citizen Savings Scheme (SCSS), along with various post‑office Time and Recurring Deposits, Kisan Vikas Patra, Monthly Income Scheme (MIS), and Savings

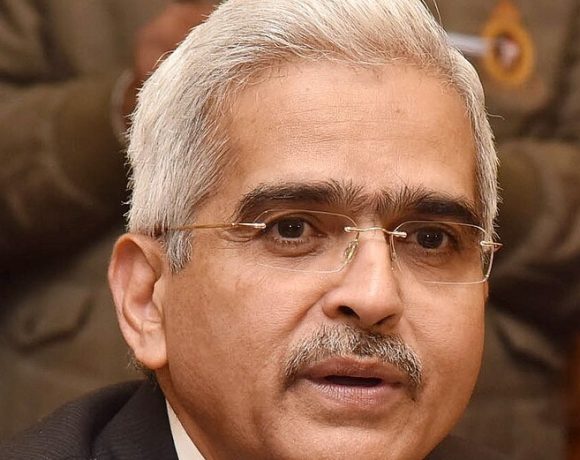

Following the government’s recent tax reductions, the Reserve Bank of India (RBI) is widely expected to lower interest rates by 25 basis points in its upcoming monetary policy review. The move is aimed at easing financial burdens on middle-class households and accelerating economic growth. Positive Economic Indicators Support Rate Cut Recent economic data indicates a

As India navigates an economic slowdown, a growing divergence in perspectives between the Reserve Bank of India (RBI) and the central government has come to light. The disagreement revolves around the pace of economic growth and the decision to maintain current interest rates. Government’s Growth Push The central government continues to focus on fiscal measures […]