SBI Transfers ₹8,076.84 Cr Dividend to Govt in FY25

The Government of India has received a dividend of ₹8,076.84 crore from the State Bank of India (SBI) for the financial year 2024–25. This payment marks a significant increase from the ₹6,959 crore received in FY24, reflecting SBI’s sustained financial performance and continued role as a vital revenue contributor for the central exchequer.

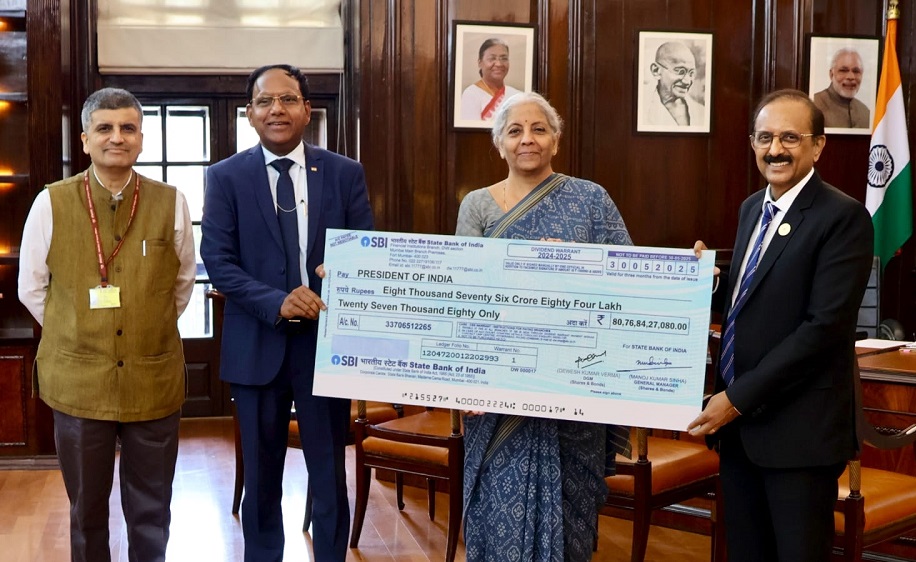

The cheque was formally handed over to Union Finance Minister Nirmala Sitharaman by SBI Chairman C.S. Setty. “Smt @nsitharaman receives a dividend cheque of Rs 8076.84 crore for FY 2024‑25 from Shri CS Setty, Chairman – @TheOfficialSBI,” her official social media account stated.

SBI Dividend Boosts Government Receipts

This payout comes at a crucial time as the government focuses on maintaining fiscal discipline and meeting expenditure without excessive borrowing. Dividend income from public sector undertakings like SBI is a key part of non-tax revenue. Alongside other major PSU contributions, such as the record ₹2.11 lakh crore transfer from the RBI this year, the government’s fiscal position appears more comfortable.

SBI’s contribution reflects its consistent ability to generate value despite sectoral challenges. With the government holding a 57.54% stake in the bank, these dividends are not just symbolic gestures but actual fiscal inflows that support budgetary planning.

Strong Fundamentals Despite Profit Dip

While SBI’s net profit for Q4 FY25 declined 10% year-on-year to ₹18,643 crore, the bank’s core financials remained resilient. Net interest income (NII) rose 2.7% to ₹42,775 crore during the same period, indicating healthy lending margins.

SBI declared a final dividend of ₹15.90 per share for its shareholders, reinforcing its commitment to returning value even during moderately volatile earnings quarters.

Improving Asset Quality and Coverage

The public sector banking giant showed marked improvement in asset quality. The gross non-performing asset (NPA) ratio dropped to 1.82% from 2.07% sequentially, while net NPA fell to 0.47% from 0.53%. To strengthen its financial buffers, SBI increased provisions to ₹6,442 crore in Q4 FY25, compared to ₹1,608 crore a year ago.

The provision coverage ratio rose by 19 basis points to 92.08%, and the slippage ratio—a measure of new bad loans—dropped to 0.55%, down 7 basis points from the previous quarter.