RBI-Government Divide Widens Over Growth and Interest Rates

As India navigates an economic slowdown, a growing divergence in perspectives between the Reserve Bank of India (RBI) and the central government has come to light. The disagreement revolves around the pace of economic growth and the decision to maintain current interest rates.

Government’s Growth Push

The central government continues to focus on fiscal measures and public expenditure to stimulate economic activity. Emphasizing growth as a priority, officials have pointed to rising inflation and global uncertainties as challenges requiring proactive government-led interventions.

RBI’s Cautious Stance

In contrast, the RBI has maintained a more conservative approach, choosing to hold interest rates steady. The central bank has expressed concerns about inflationary pressures and emphasized the need to balance economic growth with financial stability.

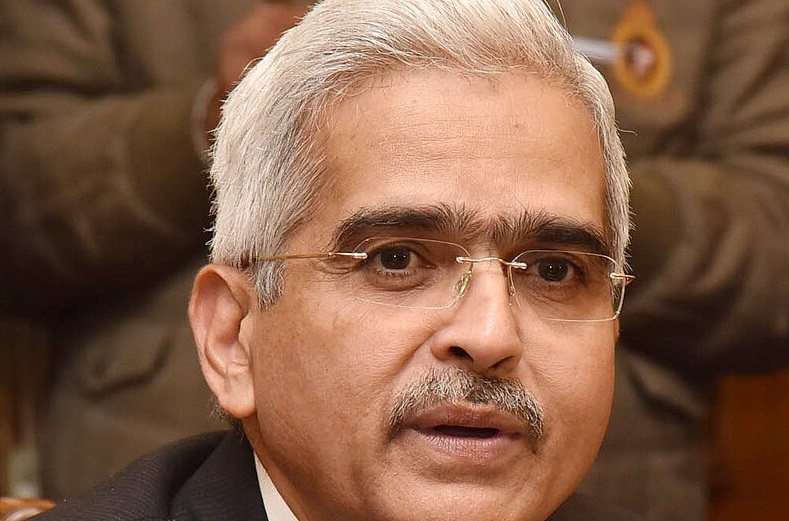

RBI Governor Shaktikanta Das recently remarked on the importance of a “calibrated approach,” highlighting that hasty rate cuts could undermine long-term financial stability.

Broader Economic Implications

The divergence reflects broader policy challenges as India strives to sustain its growth momentum amid global headwinds. With inflation hovering near the upper threshold and a fluctuating external environment, the need for cohesive policymaking has become increasingly evident.

While both institutions aim to secure India’s economic future, the contrasting strategies underline the complexities of managing growth in a volatile global economy. As discussions continue, stakeholders are closely monitoring policy decisions and their implications for India’s economic trajectory.