Qatar Joins India’s UPI Payment Network

Qatar has become the eighth country to accept India’s Unified Payments Interface (UPI). Indian travellers in Qatar can now make payments using UPI at select merchants, easing the need for cash or currency exchange.

How the Integration Works

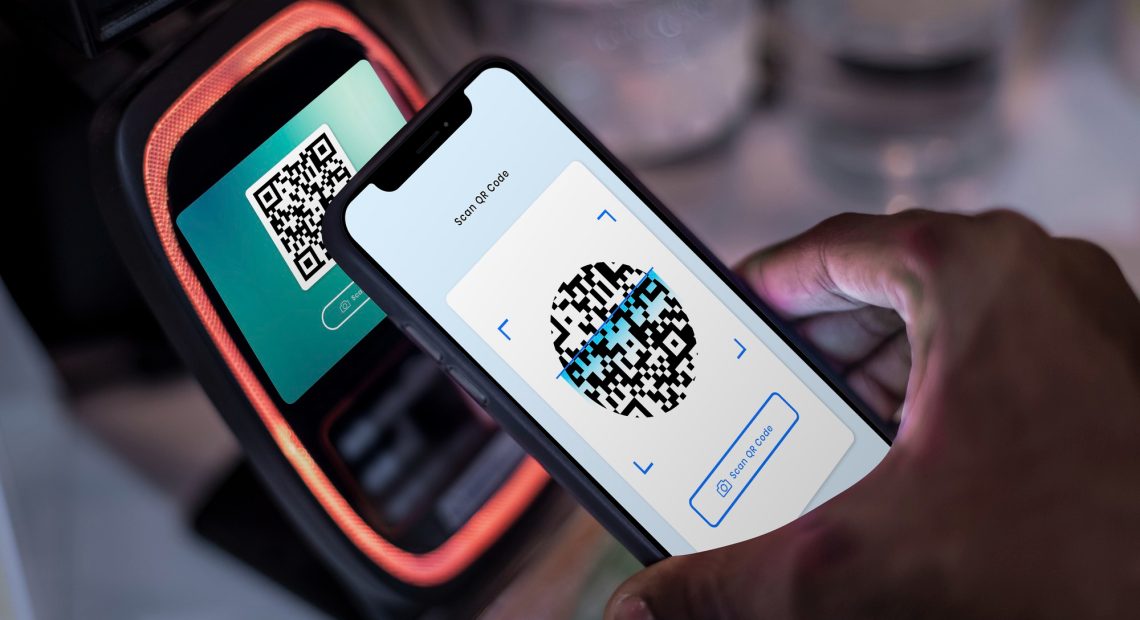

The rollout is enabled through a partnership between NPCI International Payments Ltd (NIPL) and Qatar National Bank (QNB). QR code–based UPI payments will work at QNB merchant terminals, powered by NETSTARS’ payment infrastructure. Qatar Duty Free is the first merchant to go live.

Benefits for Travellers and Merchants

This move allows Indian tourists in Qatar to make real-time digital payments in Indian rupees, eliminating forex hassles. It also encourages cashless transactions in the retail and tourism sectors, providing merchants access to more customers.

Global UPI Footprint Expands

Before Qatar, UPI was accepted in Bhutan, France, Mauritius, Nepal, Singapore, Sri Lanka, and the UAE. With this addition, its international acceptance increases to eight countries.

Next Steps

As UPI expands globally, authorities aim to build an interoperable payment network across borders. India is likely to forge more partnerships to integrate UPI in popular destinations for its citizens.