Maldives Introduces India’s UPI to Strengthen Economy, Financial Transactions

Maldives President Mohamed Muizzu has announced the introduction of India’s Unified Payment Interface (UPI) in the country, aiming to strengthen financial transactions and boost the local economy.

This move, expected to enhance financial inclusion and improve transaction efficiency, follows a recommendation from the Maldives Cabinet.

Government Push for Digital Infrastructure

The decision to adopt UPI was made after a thorough review by the Cabinet, based on a proposal submitted by the Minister of Economic Development and Trade. To implement this system, the Muizzu administration will form a consortium that includes banks, telecom companies, state-owned enterprises, and fintech firms in the Maldives. TradeNet Maldives Corporation Limited has been designated as the leading agency to oversee this project.

India’s Role in Promoting Digital Public Infrastructure

The introduction of UPI in the Maldives comes amid India’s broader push to promote its digital public infrastructure (DPI) worldwide, including systems like UPI, Aadhaar, and DigiLocker. The initiative, part of India’s global digital transformation efforts, aims to share expertise in digital services with other nations. India’s Ministry of External Affairs (MEA) has emphasized the importance of DPI in fostering cooperation on digital ecosystem-centric initiatives through India Stack.

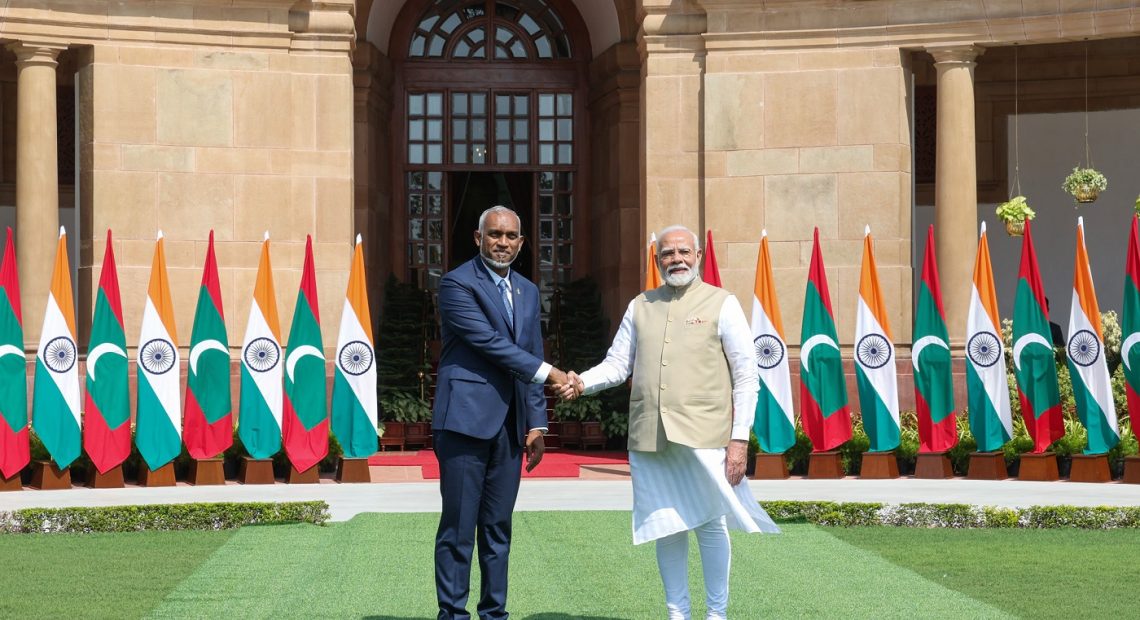

Strengthening Bilateral Digital Ties

This development follows a recent meeting between President Muizzu and Indian Prime Minister Narendra Modi, during which the two leaders reviewed the full scope of bilateral relations. Both sides agreed to collaborate on digital and financial services, with the Maldives benefiting from India’s expertise in digital public infrastructure. The launch of UPI and other digital services will play a key role in modernizing the Maldives’ financial systems and driving economic growth.