J-10 Maker AVIC Chengdu Shares Drop 18% Amid Post-Conflict Cooldown

Chinese defence manufacturer AVIC Chengdu Aircraft has seen its shares tumble nearly 18% in just over two weeks, with prices falling from 95.86 yuan on May 12 to around 76 yuan by early June. The drop follows the easing of India-Pakistan hostilities, a key geopolitical factor that had initially triggered a sharp rally in Chinese defence stocks, particularly those linked to active battlefield deployments.

J-10 Stock Rallied, Then Reversed

AVIC Chengdu’s rally had been spurred by Pakistan’s deployment of Chinese-made J-10C fighter jets and PL-15 air-to-air missiles during the height of the conflict with India. The use of the aircraft in combat situations drove investor optimism, pushing shares up over 40% during the peak of tensions. The market viewed the deployment as a validation of China’s defence export capabilities, with investors anticipating a wave of new contracts.

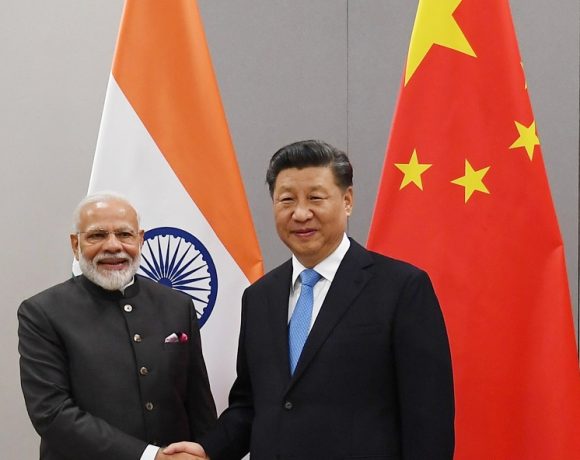

However, sentiment shifted rapidly as Indian Prime Minister Narendra Modi publicly downplayed Pakistan’s claims of air superiority, particularly mocking the notion that J-10Cs had successfully targeted Indian Air Force assets. Following this, the Indian Armed Forces launched Operation Sindoor, swiftly neutralising cross-border threats and forcing a ceasefire. With hostilities winding down, defence-sector investors began to pull back, triggering a selloff.

Defence Market Volatility

While AVIC Chengdu’s shares took a hit, other defence players like AVIC Shenyang saw an opposite trend. The latter rose over 10% on speculation that Pakistan might proceed with fresh procurement of J-35 stealth fighters. This divergence in stock performance within the same sector highlights the geopolitical sensitivity of defence equities, especially when linked to nations actively engaged in conflict.

Outlook and Risk Sensitivity

Despite the current decline, analysts note that AVIC Chengdu still holds strategic export momentum and battlefield credibility. However, its valuation remains vulnerable to regional security developments, government policy shifts, and real-time conflict narratives.

The rapid reversal in share price underscores the heightened risk-reward dynamic associated with defence manufacturers in geopolitically volatile regions. Future market moves could hinge on renewed arms deals, escalation in regional tensions, or broader policy support from Beijing for defence exports.

For now, investors are watching closely as calm returns to the subcontinent. Any signs of renewed military activity or major export agreements could quickly reverse the current trajectory. Until then, AVIC Chengdu’s stock may continue to trade under pressure in a cooling post-conflict environment.