India Tops Fastest Digital Payments List with UPI

India has emerged as the world’s fastest digital payments market, largely driven by the widespread use of the Unified Payments Interface (UPI). According to recent global financial assessments, India now records over 18 billion UPI transactions every month, making it the largest real-time retail payments system globally by volume.

Cash and Card Use on the Decline

The increasing popularity of UPI has led to a significant reduction in traditional payment methods. Debit and credit card transactions are gradually declining, and ATM cash withdrawals have also dipped. Analysts say this shift points to UPI’s growing dominance in both urban and rural markets, with users preferring the ease, speed, and reliability of real-time digital payments.

Key Factors Behind UPI’s Success

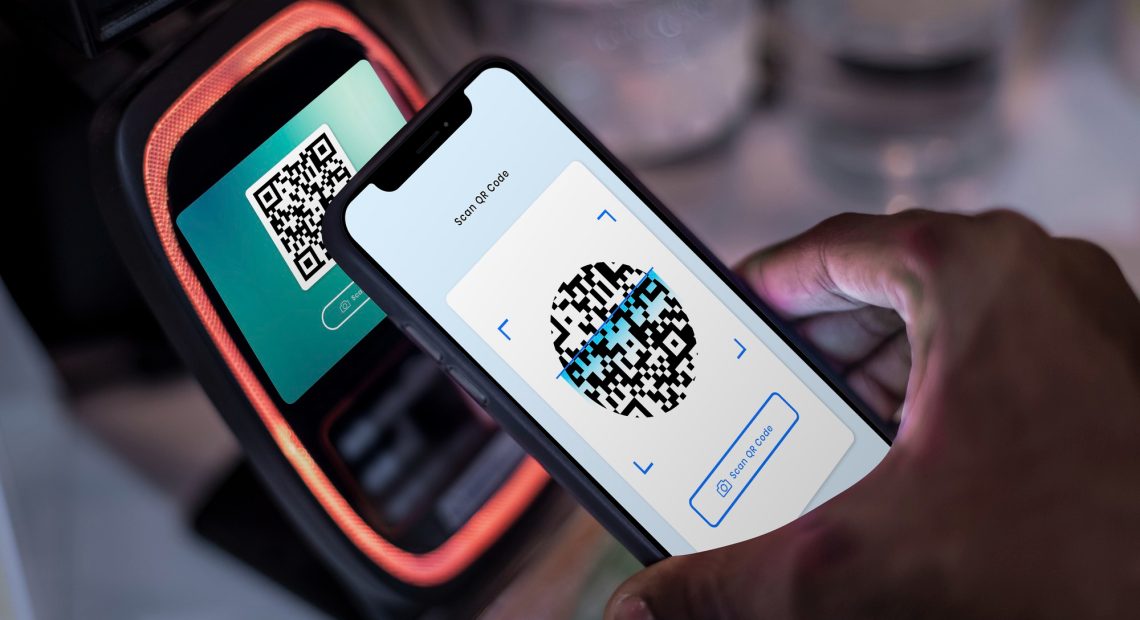

Launched in 2016 by the National Payments Corporation of India (NPCI), UPI has grown due to its ease of use and seamless integration across banks and mobile apps. Features such as real-time fund transfers, QR-code-based payments, and 24×7 access have made it a preferred method even among small businesses and local vendors.

The UPI system works over the Immediate Payment Service (IMPS) rail, ensuring that transactions happen instantly, even on weekends and public holidays. Its design allows interoperability across different banks and apps, enhancing convenience for users.

A Model for the World

UPI is now being looked at globally as a model digital payment framework. Several countries have shown interest in adopting or adapting India’s approach to boost their own payment ecosystems. The platform has also played a role in financial inclusion by bringing millions of new users into the formal digital economy.

Looking Ahead

While UPI’s growth story is strong, experts advise continued focus on cybersecurity, fraud prevention, and fair competition. There are calls to ensure smaller fintech players have equal access to the ecosystem, and that digital literacy efforts continue, especially in remote areas.

India’s leadership in digital payments not only reflects technological innovation but also highlights a shift in consumer behaviour, with a growing preference for cashless, instant transactions.