GST vs UPI: How Bureaucracy Hijacked Digital India’s Crown Jewel

India’s digital economy was supposed to be a story of empowerment — of chaiwalas flashing QR codes, fruit vendors skipping change hassles, and small businesses riding the wave of UPI-powered inclusion. But just when the country seemed to be turning the corner on cash, the bureaucracy decided to remind everyone who’s really in charge. The GST Department, in its infinite wisdom, has decided that if you dared to go digital — even while selling tax-exempt bananas — you must now explain your success with a ₹29 lakh tax demand. In one sweeping move, it has turned India’s fintech poster child into a cautionary tale. Welcome to the new India, where honesty is met with harassment, and transparency comes with a price.

The Logic Behind the Panic

At the heart of the chaos lies a simple bureaucratic assumption: if a vendor’s UPI transactions cross ₹40 lakh a year, they must be doing big business — and therefore must register for GST. Sounds logical on paper. Except the paper was soaked in tax ink and stamped with zero context.

Take the Haveri vegetable vendor who received a ₹29 lakh GST demand. His only crime? Accepting payments via UPI over four years that cumulatively crossed ₹1.63 crore. Never mind that he sold fresh vegetables, which are completely GST-exempt. The GST algorithm didn’t bother with such nuances. It saw “high digital turnover” and screamed “non-compliant!” — because in the eyes of the system, what matters isn’t what you sell, but how much money flows through your QR code.

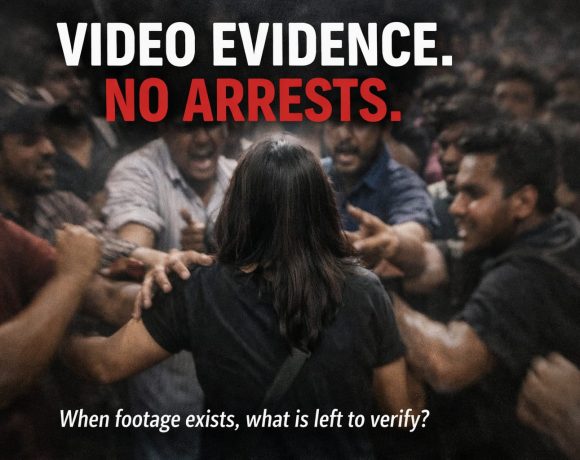

This approach ignores the core design of UPI: a transparent, traceable tool to bring informal workers into the digital economy. The government’s own flagship programs like PM SVANidhi encouraged street vendors to adopt QR-based payments, assuring them of formal recognition and credit access. But now, that same transparency is being punished — not with a phone call or an advisory, but with cold, impersonal, automated notices demanding lakhs in back taxes.

And here’s the bureaucratic kicker: the GST department didn’t even bother coordinating with the Income Tax Department. If the concern was genuine evasion, this could have been handled silently. Instead, it became a full-blown crackdown — a digital paper trail weaponized into a tax trap.

Digital India, Meet Digital Fear

Across Karnataka — and now quietly spreading across other states — the message is sinking in: “Take UPI and risk a tax bomb.” Vendors who once proudly held out QR codes now hide them under the counter. Some openly display “Cash Only” signs. Others have stopped accepting UPI altogether. The quiet revolution of digital payments, built painstakingly over years through trust, incentives, and convenience, is being undone by a single emotion: fear.

The impact is immediate and dangerous. Small traders and street vendors form the foundation of India’s informal economy. They were never expected to understand the fine print of GST laws — and they didn’t need to. After all, most of them sell exempt goods, operate well below profit thresholds, and lack the resources to hire chartered accountants. UPI was their way to leapfrog into modern commerce. Now, it’s being equated with punishment.

The absurdity of it all is staggering. A vegetable vendor accepting ₹500 per day via UPI might cross ₹1.5 lakh a month in total receipts — triggering red flags, never mind that half of it may go back into sourcing produce, paying helpers, or simply surviving. GST, however, doesn’t ask what’s left in your pocket. It just sees inflow. And for those unlucky enough to breach the ₹40 lakh “digital trail” threshold, the dreaded notice arrives — often automated, cold, and laced with bureaucratic arrogance.

In essence, the system is punishing exactly the kind of people Digital India was built for. Instead of guiding them into the formal economy, it’s scaring them back into the shadows.

When Compliance Kills Trust

In any healthy tax ecosystem, the most valuable currency is trust. Trust that the government will differentiate between willful evasion and genuine livelihood. Trust that transparency won’t be weaponized. Trust that if you follow the rules, you won’t be blindsided by Kafkaesque bureaucracy. But this trust is exactly what the GST Department is torching.

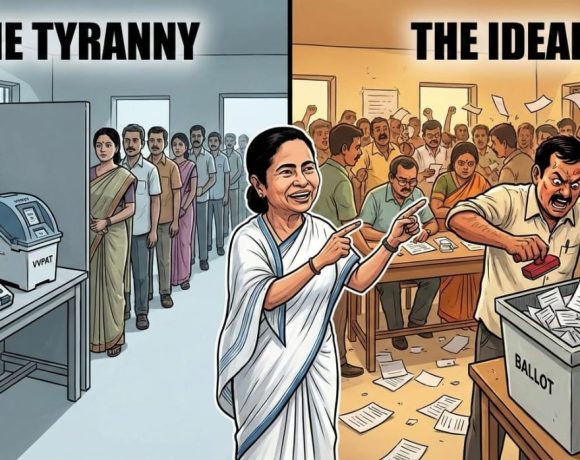

Let’s be clear — compliance is important. No one is arguing that traders dealing in taxable goods should evade GST or income tax. But the current enforcement pattern isn’t about plugging tax leaks; it’s about showing performance on spreadsheets. By using crude filters like “UPI turnover > ₹40 lakh” without examining context — such as goods sold or margins earned — the department is punishing the wrong people for the wrong reasons.

And here’s where it becomes tragicomic. Even if a vendor is selling only GST-exempt goods, once they cross ₹40 lakh in turnover, they technically fall under the registration threshold — not for paying tax, but for filing returns and issuing invoices. For a local banana seller who doesn’t speak English, let alone understand GSTR-1 filing, this is a compliance death spiral.

Rather than simplifying the path to compliance, the system is criminalizing digital visibility. And in doing so, it’s killing the very motivation that prompted vendors to embrace UPI in the first place: ease, speed, and safety. When people start believing that being visible equals being punished, they don’t hire chartered accountants — they shut down their QR codes.

This isn’t just bad tax policy. It’s reverse evolution.

The Road Back: Can UPI Trust Be Rebuilt?

The damage is done, but it’s not irreversible — yet. To salvage Digital India’s crown jewel, the government must act swiftly and decisively. First and foremost, the GST Department must issue immediate clarifications that mere receipt of UPI payments above ₹40 lakh does not automatically trigger tax liability — especially for those selling GST-exempt goods like fruits, vegetables, and other essentials.

Secondly, instead of issuing cold notices, the department should deploy a trust-based outreach model. That means advisory letters, helplines, multilingual support, and local workshops for small vendors to explain their rights and obligations. Use the same Aadhaar-linked contact databases that were used to push UPI to now educate and assure.

Third, the GST and Income Tax departments must talk to each other. If there’s genuine tax evasion, handle it discreetly, professionally — not through headline-hunting crackdowns that scare the entire market. Let’s not forget: even large enterprises with hundreds of crores in evasion get “summons” and “raids,” not mass digital notices. Why are sabziwalas held to a stricter standard?

Lastly, there’s a need for political leadership — not just bureaucratic course correction. The very same leaders who flaunt UPI as India’s soft power in global forums must now step in to protect its grassroots credibility. If small traders abandon digital payments en masse, it won’t just be a fintech regression — it’ll be a reputational crisis.

The bottom line? You cannot build a Digital India on a foundation of fear. Either UPI is a tool for inclusion, or it’s a trapdoor to tax harassment. The government must choose — and it must choose now.