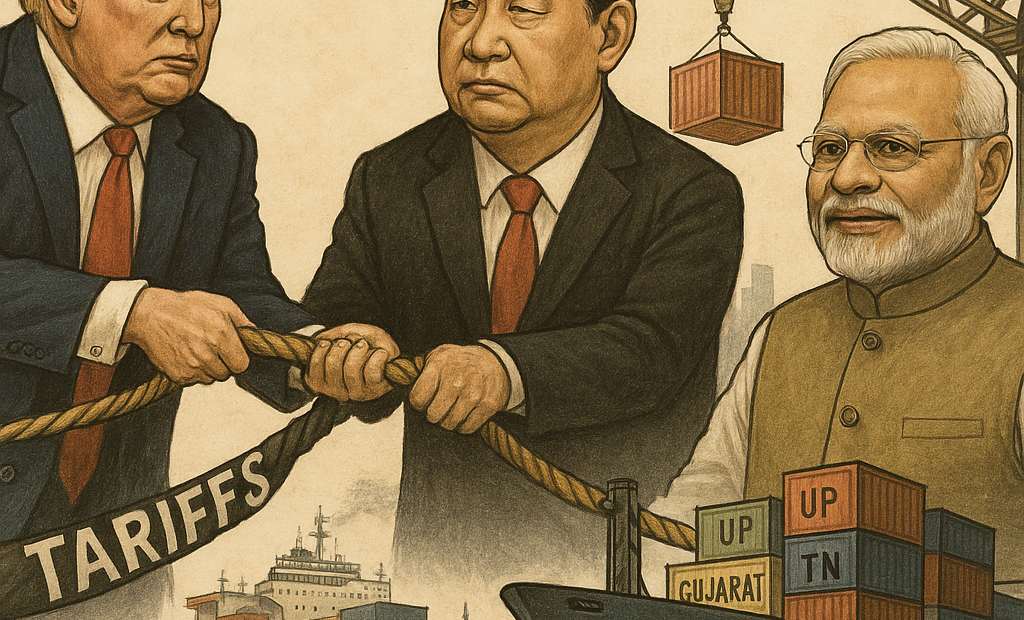

From Bystander to Beneficiary: How Indian States Capitalized on the Trump Tariff War

This content is exclusive to BPN EduPulse Members You’ve reached a story that’s part of our premium journalism—sharp, bold, and deeply reported. Login or Join BPN EduPulse to continue reading.