ED Alleges Gandhis Usurped ₹2,000 Crore in National Herald Asset Grab

The Enforcement Directorate (ED) has accused Sonia Gandhi and Rahul Gandhi of orchestrating a scheme to acquire approximately ₹2,000 crore worth of assets belonging to Associated Journals Limited (AJL), the publisher of the National Herald newspaper. Allegedly, the assets were transferred to Young Indian Pvt Ltd (YI) in exchange for repayment of a ₹90 crore loan—an arrangement ED contends was designed to benefit only select individuals.

YI, in which Sonia and Rahul Gandhi each hold 38% stakes (76% jointly), allegedly converted the ₹90 crore loan extended by the All India Congress Committee (AICC) into equity. The ED questions this deal, pointing to the mismatch between the nominal loan amount and the asset value seized.

Alleged Sham Transaction

Despite AJL reporting operating losses, the agency claims the company held substantial assets, which could have covered the loan comfortably. Yet, ED contends that the conversion deal was contrived and disproportionate, effectively allowing YI to acquire valuable assets at a fraction of their worth. ED’s legal team described the transaction as “absurd” and accused the Gandhis of engineering an unfair transfer.

Money Laundering Charges

Legal charges have been filed under Sections 3 and 4 of the Prevention of Money Laundering Act (PMLA), targeting Sonia and Rahul Gandhi, along with others including Sam Pitroda, Suman Dubey, Motilal Vora, Oscar Fernandes, and YI. The agency alleges the transfer yielded illicit gains of at least ₹142 crore, suggesting the deal was more than a mere revival effort.

Political & Institutional Implications

In its court submissions, the ED indicated that the AICC itself could come under scrutiny if it is established that party assets were used improperly. The agency emphasized that the Gandhis’ historical link to AJL does not necessarily justify the transfer of its assets to a private entity under these terms.

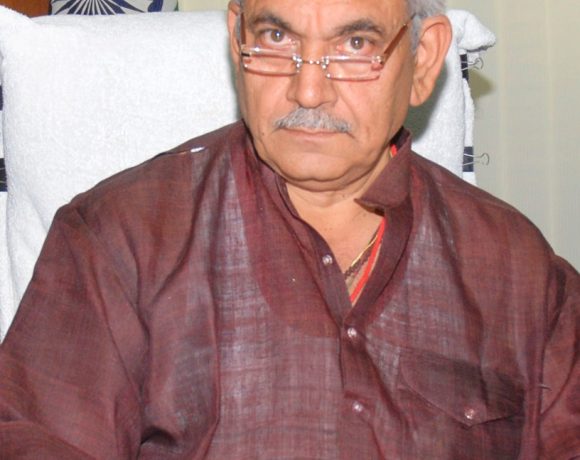

Ongoing Proceedings

The trial is currently underway before a designated special court, presided over by Judge Vishal Gogne, with daily hearings continuing throughout the ongoing month. The central question remains whether the asset transfer constituted a legitimate revival or an act of financial impropriety.

As the case advances, it underscores the growing scrutiny of political figures and highlights the intersections between political heritage, corporate strategy, and allegations of asset misuse.