Crude Lies: The Truth Behind India’s Static Fuel Prices in a Falling Oil Market

In a world where every rupee counts, Indian fuel consumers find themselves caught in a peculiar paradox. Crude oil prices have been tumbling on the global stage—by over 15% in recent months—yet the cost of filling up your tank in Mumbai, Delhi, or Bangalore has barely moved an inch. The numbers simply don’t add up, and the official silence only makes them more suspicious. If oil is cheaper, why are we still paying the same? What’s really going on behind the no-change boards at your local petrol pump?

The Global Crude Price Fall — What Changed?

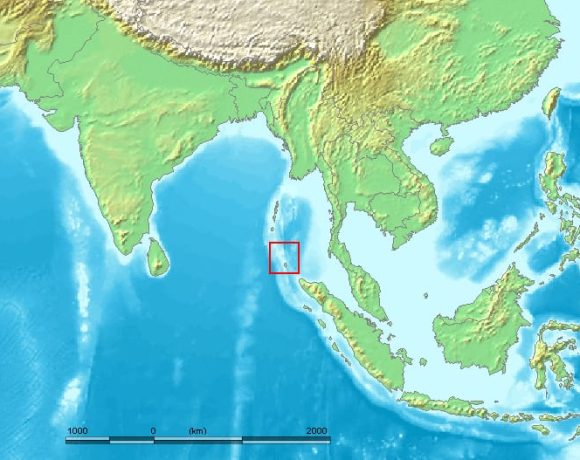

In the international oil market, prices have seen a marked decline due to a combination of global oversupply, lower-than-expected demand, and economic uncertainty. Brent crude and West Texas Intermediate (WTI) have both dropped by more than 15% from their recent peaks. Saudi Arabia’s decision to slash July crude prices to Asia—the lowest since 2021—is a signal that producers are struggling to sustain prices in a market flooded with supply. The OPEC+ alliance has also announced a gradual unwinding of production cuts, adding to the pressure. Under normal circumstances, such a drop in global crude would have translated into cheaper fuel at Indian pumps. But not this time.

The Indian Pump Paradox — Why Prices Didn’t Budge

Despite these global developments, retail fuel prices in India have remained stubbornly high. In Mumbai, petrol still hovers above ₹104/litre, while diesel is around ₹90/litre. Delhi, Chennai, and Kolkata show similar rigidity. These prices have not reflected the 5% reduction that a drop in crude prices should have enabled. This is not the first time Indian fuel consumers have been shortchanged, but the scale and silence this time are staggering. Historically, India’s dynamic pricing system has allowed for daily revisions based on global trends. Yet today, it’s as if the market has been paused—selectively.

The Excise Sleight of Hand — Tax Raised, But Not Seen

What made things worse—and far less transparent—was the government’s move in April 2025. The Centre hiked excise duty on petrol and diesel by ₹2/litre. But instead of passing this on to consumers and facing public outrage, the oil marketing companies (OMCs) were directed to absorb the hike. This clever sleight of hand allowed the government to keep prices “unchanged” while quietly increasing tax collections. The public perception was that prices remained stable in a volatile world—but in truth, what should have been a price drop became a buffer for a hidden tax increase.

The Math of Overpayment — A ₹1000 Crore Daily Mirage

When you run the numbers, the deception becomes massive. Based on India’s daily fuel consumption—about 110 million litres of petrol and 260 million litres of diesel—the expected reduction of 5% should have led to a decrease of ₹5 per litre or more. Instead, prices barely moved. Even if you account for the ₹2/litre excise hike absorbed by OMCs, the net relief to consumers was far below what it should have been. The result? Indian consumers are overpaying by an estimated ₹950 crore per day. That’s nearly ₹30,000 crore a month in overpayment—siphoned off invisibly.

Where Does the Money Go? The Hidden Beneficiaries

So, where is all this extra money going? It’s not being burned at the pump. A major chunk—around ₹740 crore/day—is going straight to the government in the form of backend excise collections. Even though the tax wasn’t passed on to the consumer directly, OMCs still pay it when fuel leaves the depot. Another portion of the surplus remains with the OMCs themselves, helping them cushion inventory losses, bolster profits, and stay in the government’s good books. The government, which owns majority stakes in Indian Oil, BPCL, and HPCL, benefits indirectly via higher dividends and income tax from these firms. Meanwhile, not a single rupee of that surplus makes its way back to the taxpayer who funded it.

The Illusion of Dynamic Pricing

India’s fuel pricing mechanism was designed to reflect global crude oil movements daily. But over time, it has become clear that dynamic pricing is more discretionary than automatic. During elections, prices remain mysteriously frozen. When global prices rise, revisions are swift and unapologetic. But when prices fall, the system is conveniently sluggish. This selective responsiveness makes a mockery of the principle of market linkage. It raises the question: are Indian fuel prices truly market-driven, or are they politically and fiscally managed instruments masked in economic jargon?

Accountability, Transparency, and What Must Change

This situation demands transparency. The government must release public pricing models showing how crude oil cost translates into final retail prices. A breakup of every litre sold—including base price, excise, VAT, marketing margin, and dealer commission—should be mandated at fuel stations. Furthermore, any excise hike absorbed by OMCs must be publicly disclosed and accounted for in annual budget documents. If the government wants to treat OMCs as fiscal instruments, then citizens deserve a say in how their wallets are being used as shock absorbers for policy.

A Market that Punishes Loyalty

In the end, Indian consumers are not just paying for petrol and diesel—they’re paying for a carefully engineered illusion. While global headlines scream of falling oil, Indians continue to pay pre-fall prices. This isn’t just a case of poor policy—it’s a betrayal of trust. A true market serves its participants. In India, the fuel market punishes loyalty and rewards silence. The real fuel crisis is not one of supply or demand—but of accountability.