India is close to concluding a long-pending trade agreement with the European Union, according to the country’s trade secretary. He said negotiations have reached an advanced stage, with most chapters settled and only a few technical issues left to be resolved. Timing Linked To High-Level

The Indian government has imposed a three-year safeguard tariff on select steel products to curb a surge in low-priced imports and protect domestic manufacturers. The decision follows concerns raised by the steel industry over rising imports that were impacting local production, prices, and capacity utilisation. Details of the Safeguard Duty Under the new measure, the […]

All Indian exports will receive complete duty-free access to the Australian market starting January 1, marking the final phase of tariff elimination under the India–Australia Economic Cooperation and Trade Agreement. With this step, Australia will remove customs duties on the remaining tariff lines, extending zero-duty treatment to 100 percent of Indian goods covered under

India is increasingly likely to fall short of its ambitious USD 1 trillion export target for the fiscal year 2025–26, according to trade analysts. The shortfall is attributed to weak global demand, a slowdown in international trade and rising protectionist measures that have weighed on shipment growth. Merchandise Exports Under Pressure Merchandise export growth has […]

India has initiated talks with Mexico after proposed tariff increases threatened to impact nearly $2 billion worth of Indian exports, officials said. The discussions are taking place at the technical level, with India seeking ways to prevent higher duties from affecting key export sectors. Mexico has announced plans to impose higher import tariffs on countries […]

India’s exports recorded their fastest growth in three years, defying concerns over higher tariffs imposed by the United States under President Donald Trump. Official data shows that outbound shipments grew strongly in recent months, driven by resilient demand from key markets, especially the US, and improved competitiveness of Indian goods. Government officials said the

India’s trade deficit narrowed to $24.53 billion in November, helped by a moderation in imports and relatively stable export performance. The improvement marked a reduction from the wider deficit recorded in the previous month, offering some relief to policymakers monitoring external sector pressures. Officials said the narrowing of the gap was largely driven by a […]

A senior US trade official has said that India has presented the “best offers ever received” during recent discussions on bilateral trade. The official revealed that negotiators from both sides are close to finalising agreements on several issues that have remained unresolved for years. Old disputes back on the table The current round of talks […]

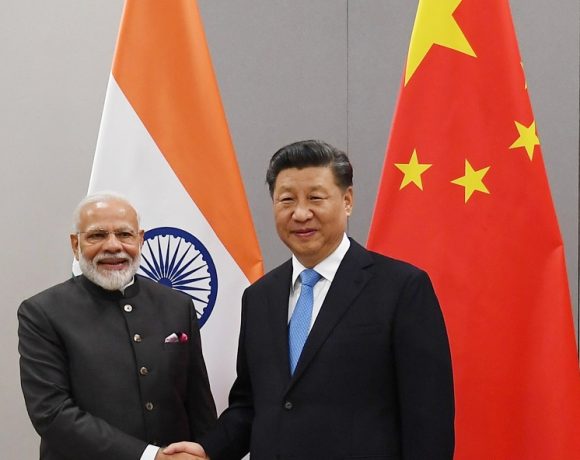

India’s exports to China continued to rise for seven consecutive months in FY26, supported by increased shipments of petroleum products, telecom instruments and marine goods. Official trade data shows that exports to China touched USD 10.03 billion during April to October 2025, marking a strong 24.7 percent year-on-year increase. October Sees Sharp Jump In October […]

India’s merchandise trade deficit widened to an all-time monthly high of USD 41.68 billion in October 2025, up from USD 32.15 billion in September. The figure far exceeded market expectations of around USD 29 billion. Drivers Behind the Widening Gap Despite weak global demand, India’s merchandise exports declined by roughly 11.8% year-on-year to USD 34.38 […]