Canada Scraps Digital Tax, Resumes Trade Talks with US

In a dramatic policy reversal, Canada has scrapped its proposed 3% Digital Services Tax just hours before it was to take effect. The levy, aimed at large American tech companies such as Apple, Amazon, Google, and Meta, had been a major point of contention in US–Canada relations. The decision clears the path for the resumption of bilateral trade talks, which had been suspended by President Donald Trump in protest.

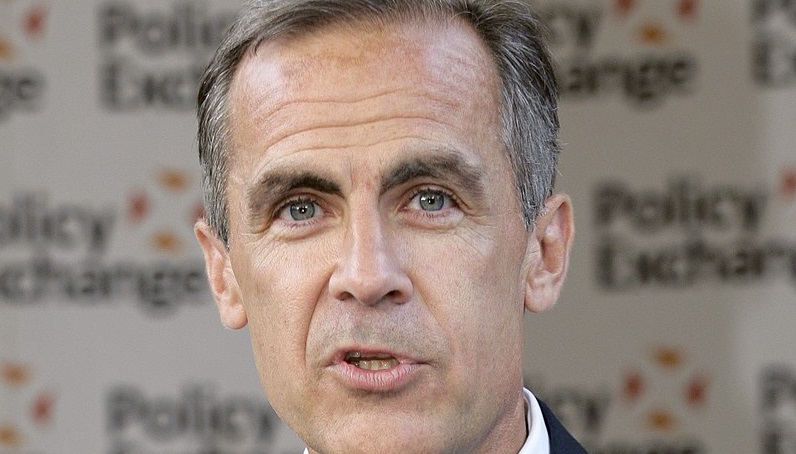

Prime Minister Mark Carney’s government officially revoked the tax on June 29, defusing tensions that had threatened to escalate into a broader trade standoff. The tax was set to apply retroactively to 2022 revenues earned by foreign tech companies from Canadian users. Its removal now paves the way for both nations to restart economic and security negotiations, with a new deadline of July 21 for reaching a comprehensive agreement.

Trump Had Called Off Talks Over Tax

President Trump had earlier slammed the digital tax as “a direct and unacceptable assault on American companies,” prompting him to halt ongoing discussions. He had warned of retaliatory tariffs targeting Canadian exports, including steel, aluminum, and automotive parts. With Canada backing down, Trump has agreed to return to the negotiating table under a reset framework.

Economic and Diplomatic Stakes High

The digital services tax had emerged as a flashpoint in international economic diplomacy. While Canada had argued that digital giants needed to contribute a fair share to the Canadian economy, Washington viewed it as discriminatory and unilateral. The reversal is seen as an effort to restore economic stability, avoid retaliatory tariffs, and foster a new phase of US–Canada economic cooperation.

Relief for Tech Firms and Industry

The decision was welcomed by tech companies and business groups, which had warned the tax would increase operational costs and distort the market. The rollback avoids a potentially costly transatlantic dispute and signals Canada’s willingness to seek multilateral solutions on taxing the digital economy.